Last Updated on February 23, 2026 by Amrita Das

You may be thinking of considering a Fast Loan Advance to cover your sudden costs. But you have a question Is Fast Loan Advance a legit lending platform? I am here to clear your doubts as I will give you a comprehensive review of Fast Loan Advance and am sure you will get your answer after learning this guide. So, let’s read if this platform is legitimate or if it falls under a scam.

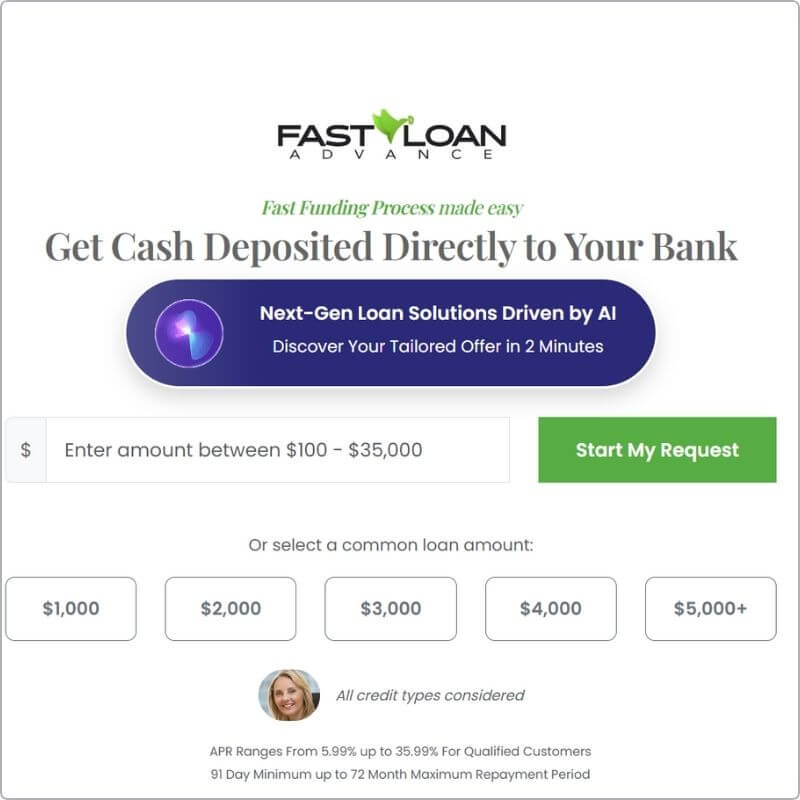

Explore Fast Loan Advance

Fast Loan Advance is a lending network that connects borrowers with multiple lenders, offering more options and increasing the chances of loan approval. The website operates as a service provider and does not charge any fees or endorse specific products.

They collect personal information from borrowers and share that information with partners in their lender’s network. Headquartered in Calabasas, United States, Fast Loan Advance has a wide range of lenders with varying lending methods, ensuring that borrowers can find the right loan for their needs.

Each lender within the network has their policies, so it is important for borrowers to carefully review the disclosures and lending practices before agreeing to a loan.

For any inquiries or assistance, Fast Loan Advance can be reached via email at info@fastloanadvance.com or by phone at (833) 710-3200. The company’s office is located at 26610 Agoura Road, Suite 210, in Calabasas.

Read More: Is The Cup Loan Program Real Or Fake? Learn The Truth

Fast Loan Advance: Features and Services

They understand that time is of the essence when it comes to financial emergencies, which is why they strive to make the process as quick and easy as possible.

Easy Application Process

One of the main features of Fast Loan Advance is our easy application process. All you have to do is fill out a brief online form with your essential financial information, and they will match you with potential lenders based on your needs and circumstances.

This saves you the hassle of contacting individual lenders and allows them to find the best loan solution for you.

Accepts All Credit Types

At Fast Loan Advance, they believe that everyone should have access to emergency funds when needed. That’s why they allow all credit types, regardless of your circumstances. Whether you have good or bad credit, their network of lenders can offer solutions that work for you.

Alternative to Traditional Loans

Fast Loan Advance is a great alternative to traditional loans. While banks may require extensive documentation and take several days to process a loan, their service offers a faster and easier experience.

This is especially beneficial for those who need quick cash to cover unexpected expenses but don’t want to go through the lengthy processes of traditional loans.

Multiple Loan Options

They work with a variety of lending partners who offer different loan options, ensuring that there is something for everyone. Whether you need a short-term loan, installment loan, or payday loan, their network of lenders has you covered.

This allows them to cater to different financial needs and provide personalized solutions for each individual.

Free of Charge Service

Fast Loan Advance is a no-cost service allowing you to apply and use their services without fees. However, remember that the lenders you are matched with may charge interest and other fees.

Transparent Terms

At Fast Loan Advance, they believe in transparency and honesty. That’s why they make sure to provide all the necessary information about their loan offers upfront.

From fees and interest rates to payback plans, I want you to know that their terms and circumstances are clearly stated for your understanding.

Customer Service

In this platform, their customer service representatives are available 24/7 to assist and support you with your loan application process. The staffs are trained and knowledgeable in all aspects of their services, and can provide guidance and assistance with any questions or concerns you may have.

Secure and Confidential

At Fast Loan Advance, they value your privacy and security. That’s why they use secure online forms and have partnerships with authorized lenders who adhere to strict data protection policies. You can trust them to keep your information safe and confidential throughout the loan process.

Read More: What Is Conventional Rehab Loan? A Step-By-Step Guide

Who is Eligible to Apply for Loans from Fast Loan Advance?

Fast Loan Advance is a platform that prioritizes inclusivity and accessibility for all borrowers. Regardless of your credit history, you can apply for loans through their services. The process is simple – you provide information about your financial situation through an online application form on the Fast Loan Advance website.

From there, the platform works tirelessly to connect you with potential lenders who may be willing to offer you a loan based on your specific circumstances.

It’s important to note that each lender will have their unique requirements and criteria for approval. Still, Fast Loan Advance aims to match borrowers with flexible lenders who are open to considering all types of credit profiles.

This gives individuals with different credit backgrounds the opportunity to access necessary funds and potentially improve their financial situation. With Fast Loan Advance, anyone can apply for loans without worrying about their credit score holding them back.

Basic Loan Requirements of Fast Loan Advance

To qualify for a loan, there are some basic requirements that every borrower must meet. First and foremost, you must be at least 18 years old to apply for a loan. This is because entering into a legal contract with a lender requires you to have reached the age of majority. Additionally, you must be a U.S. citizen or permanent resident in order to be eligible for most loans.

Furthermore, lenders will want to ensure that the borrower has a stable source of income before approving any loan application. Whether it’s through employment or another form of steady income, lenders need assurance that the borrower will be able to make timely repayments on the loan.

Having a bank account is another important requirement for obtaining a loan. This allows for the lender to easily transfer the funds to the borrower and also sets up a convenient way for repayments to be made.

Applying for a Loan on Fast Loan Advance Made Easy

So, how can you apply with them? Here, I will explain the simple steps and you can easily sign up and get access to multiple loan offers from various lenders.

Step 1: Visit the Fast Loan Advance Website

To begin your loan application process, visit the Fast Loan Advance website. The interface is designed to make navigation easy and intuitive, even for first-time users.

Step 2: Fill Out the Online Application Form

Once on the website, you will find an online application form that requires basic personal information such as your name, email address, phone number, and current address. You will also need to provide details about your job status and income.

Step 3: Submit Your Application Form

After completing the application form, submit it electronically through the website. This information will then be used by Fast Loan Advance to match you with potential lenders who are willing to offer you a loan.

Step 4: Review Your Loan Offers

Once your application is processed, you will receive a list of loan offers from different lenders. Each offer will include details on repayment conditions, interest rates, and loan amounts for your consideration.

Step 5: Choose the Best Option

Take the time to review each loan offer carefully before making your decision. Consider factors such as repayment terms, interest rates, and loan amounts to choose the option that best suits your needs.

Step 6: Work Directly with Your Chosen Lender

After selecting a lender, you will work with them to complete the loan transaction directly . This may involve accepting the loan terms or providing additional documents as requested by the lender.

Step 7: Receive Your Funds

Once your loan is accepted and closed, the funds will be deposited into your bank account. In most cases, you can expect to receive the money on the following business day.

Understanding the Fees Associated with this Loans

In the case of taking out a loan, it’s important to fully understand any potential fees that may be associated with the process. While Fast Loan Advance services themselves are provided at no cost, the lender you choose to work with will likely have their own set of fees and interest charges.

They must provide you with complete disclosure of these terms before approving your loan. It’s your responsibility as the borrower to carefully review and understand these terms before signing any loan agreement.

This will ensure that you are fully aware of any fees or charges involved, allowing you to make a well-informed decision about taking out a loan.

Flexible Loan Options with Favorable Repayment Terms and APR

Fast Loan Advance offers a range of loan amounts to cater to the varying financial needs of its clients. With a minimum loan amount starting at $100 and a maximum of $35,000, borrowers have the flexibility to choose the loan amount that best suits their requirements.

Minimum and Maximum Loan Amounts for Different Financial Needs

The minimum loan amount of $100 is suitable for those who require quick cash to cover unexpected expenses or short-term financial gaps. This option provides immediate relief without any major long-term commitments.

On the other hand, the maximum loan amount of $35,000 is ideal for borrowers who require a larger sum of money to take care of major expenses such as debt consolidation, home renovations, or significant personal expenditures.

With this higher limit, clients have the ability to manage their financial needs without any restrictions.

Favorable Repayment Terms and APR

Fast Loan Advance offers competitive Annual Percentage Rates (APR) ranging from 5.99% to 35.99%. However, it is important to note that the APR may vary depending on the lender within their network.

The minimum repayment period for personal loans is 91 days, while the maximum is 72 months. This allows borrowers to choose a repayment term that suits their financial situation and comfort level.

However, it is crucial for you as a borrower to carefully review the loan agreement before accepting a loan from a lender within Fast Loan Advance’s network. This is because the APR and repayment terms may differ from what is mentioned on their website.

Is Fast Loan Advance Legit?

Now let’s come to your main question – Is Fast Loan Advance Legit? From the above discussion, you may have cleared a lot. However, let’s look at the main points here again.

The Security Measures of Fast Loan Advance

Fast Loan Advance takes the security of its customers’ information very seriously. The platform utilizes 256-bit SSL encryption, which is one of the highest levels of protection available in the online lending industry.

This ensures that all communication between the website and the borrower’s web browser is secure, making it extremely difficult for hackers to access sensitive data. Moreover, Fast Loan Advance also has disclaimers clearly stated on their website, emphasizing that they are not a direct lender and do not originate or process loans.

This level of transparency and honesty sets them apart from other scam loan companies that often hide their location and deceive borrowers. By providing a physical address, Fast Loan Advance shows their commitment to building trust and credibility with their customers.

The Reliability of Fast Loan Advance

With years of experience in the online lending industry, Fast Loan Advance has become a reputable and trustworthy source for quick loans. This is due to their efficient matching process that connects borrowers with reliable lenders who offer customized loan options tailored to each individual’s financial needs.

By collaborating with established and well-known lenders, Fast Loan Advance ensures that customers receive prompt and dependable assistance.

The Importance of Transparency

One of the key factors contributing to the legitimacy of Fast Loan Advance is their commitment to transparency. They provide users with clear information about potential loans, including all terms and conditions, before finalizing any agreement.

This level of transparency not only builds trust with customers but also protects them from potentially risky or scam lenders.

Read More: What Is Caveat Loans? An Essential Guide To Know Everything

Is Fast Loan Advance Legit: An exceptional customer experience

Here I am going to give a customer review who recently used Fast Loan Advance. So let’s see what he says about Fast Loan Advance: I can confidently say that they provide an exceptional customer experience. From start to finish, their team worked tirelessly to ensure my satisfaction.

When I first reached for a loan, I was a little nervous and unsure of what the loan process would entail. However, the team at Fast Loan Advance immediately put me at ease with their attentive and caring approach. They listened carefully to my financial situation and gave practical advice on the best loan options for me.

Throughout the loan process, Fast Loan Advance made sure I felt comfortable every step of the way. They clearly explained all the terms, making sure I fully understood the loan before making any commitments.

This level of transparency and communication is rare in the lending industry and has had a significant impact on my overall experience.

What really sets Fast Loan Advance apart from other lenders is their commitment to customer care. Another best part of them is that even after getting my loan, their cooperation did not stop.

They check in regularly to make sure I have all the information I need to pay off the loan and are always available to answer any questions I may have.

I have never come across a company that values its customers as much as Fast Loan Advance does. Their team goes above and beyond to make sure each person feels like more than just a number. I highly recommend them to anyone looking for reliable financial support with an exceptional customer experience.

Is Fast Loan Advance Safe: Poor Experience

High APR and Charge

One of the most common complaints among payday loan users is the high annual percentage rates (APRs) that many lenders charge. While these rates are to be expected with this type of loan, they can often catch borrowers off guard if not carefully reviewed beforehand.

Minimal Clarity on Terms

Another issue that some borrowers have experienced is a lack of transparency when understanding the full cost of their loans. This can lead to dissatisfaction when they are matched with a lender and discover additional charges that were not made clear during the application process.

Incompatible Customer Support

Since each lender has their own customer service team, there can be significant differences in the quality of support provided. Some borrowers have reported receiving excellent assistance from their lender, while others have faced challenges in getting the help they need.

How To Evaluate The Legitimacy: Key Factors to Consider

When considering taking out a loan, it is important to carefully evaluate the legitimacy of the lender. This will not only ensure that you are dealing with a reputable and trustworthy institution but also protect you from potential scams or fraudulent activities.

Below are some key factors to consider when evaluating the legitimacy of Fast Loan Advance or any other immediate loan provider.

Transparency on Loan Terms, Interest Rates, and Repayment Plans

One of the first things to look for when evaluating the legitimacy of a fast loan provider is their transparency in regard to loan terms, interest rates, and repayment plans.

Legitimate lenders should clearly state all details about their loan offers, including the total amount you will be borrowing, the interest rate and any additional fees or charges, and the repayment schedule. If a lender is not upfront about these important details, it may be a red flag that they are not a legitimate company.

Avoiding Upfront Fees

Another key factor to consider when evaluating legitimacy is whether or not a lender requests any upfront fees or payment before approving your loan.

Legitimate lenders typically do not require any upfront payments and will only charge fees once your loan has been approved and funded. Be wary of any requests for payment before approval, as this could indicate fraudulent activity.

Researching Online Reviews and Customer Experiences

In addition to considering the above factors, it is also helpful to do some research on the lender’s online presence and customer experiences. Look for reviews from previous customers to gauge their satisfaction with the lender’s services and credibility.

If a lender has consistently negative reviews or a lack of online presence, it may be best to avoid them altogether.

The Legitimate Players: Reputable Loan Companies

When evaluating legitimacy, it can also be helpful to look at the company’s associations and affiliations. Reputable loan companies are often affiliated with established financial institutions, such as banks or credit unions.

This not only adds credibility to the lender but also ensures that they adhere to industry regulations and standards.

Pros and Cons of Fast Loan Advance

Pros:

- Fast and trouble-free application process: One of the main advantages of using the Fast Loan Advance platform is the comfort and simplicity of their online application process. This saves time and eliminates paperwork, making it a hassle-free experience.

- Speedy funding: Another benefit of this platform is that they provides speedy funding. If approved, you can expect to receive your funds as soon as the next business day, which can be crucial in emergencies.

- Workable credit requirements: Unlike traditional loans from banks, lenders on this platform are willing to work with borrowers without perfect credit. This opens up opportunities for those who other lenders might turn down.

- Clear terms: Fast Loan Advance ensures transparency with no hiddenness by providing clear information about loan terms, interest rates, and fees upfront. This allows borrowers to make well-informed decisions and avoid unexpected costs.

Cons:

- High interest rates: One of the huge pitfalls of this network is its high APRs. They rates can range from 200% to thousands percent or even higher. This means that borrowing a small amount could result in paying back significantly more because of the high interest.

- Low paying-back terms: The second pitfall is their short repayment periods. Most lenders in their network offer a few weeks for borrowers to repay the loan in full, which can be challenging for those who are already struggling financially.

- Risk of getting trapped in a debt cycle: Due to the quick and easy access to funds, there is a potential for borrowers to fall into a vicious cycle of debt if they are unable to repay their original loan on time. This can lead to taking out multiple loans to cover the costs, resulting in a never-ending cycle of debt.

- Insufficient loan amounts: The network of Fast loan Advance is not suitable for larger financial needs as they typically offer small amounts. This may not be enough to cover significant expenses or emergencies, leaving borrowers with limited options.

Best Alternatives of Fast Loan Advance

5kFunds

5kFunds can be a game-changer for lending purposes. With its user-friendly online platform and fast funding times, 5kFunds is making it easier for people with all types of credit to access loans. Here is the best part?

Borrowers can check their rates without any impact on their credit score. This gives them the freedom to explore their options and choose the best loan for their needs.

With a minimum age requirement of just 18 years, 5kFunds is opening up opportunities for young adults who may need financial assistance. Plus, with no minimum credit score required, individuals with less-than-perfect credit can also apply for a loan through 5kFunds’ large network of lenders.

From small loans starting at $500 to larger amounts up to $35,000, 5kFunds truly caters to the diverse financial needs of its borrowers. With a range of APRs from as low as 5.99% to a maximum of 35.99%, 5kFunds strives to provide fair and competitive interest rates for its customers.

And with loan terms ranging from 6 months to 5 years, borrowers can choose a repayment plan that works best for them. It’s no wonder that 5kFunds has become a top choice for those in need of quick and trouble-free loans.

Low Credit Finance

Another great lending platform for those who struggling to secure loans due to their poor credit history. By considering factors beyond just credit scores, they provide borrowers with a higher chance of approval and access to funds when needed.

With a wide range of loan amounts ($100 to $50000) and flexible repayment terms (2 months to 7 years), Low Credit Finance allows borrowers to personalize their loans based on their particular needs and financial case.

Their fast online application process also makes it convenient for individuals to apply and receive an approval decision within minutes.

This can be extremely helpful for those facing unexpected expenses or emergencies. Additionally, the minimum age requirement of 18 allows young adults to also benefit from this lending platform.

BadCreditLoans.com

Unlike traditional lenders who often deny loan requests due to poor credit scores, BadCreditLoans.com connects borrowers with direct lenders who are willing to work with individuals despite their financial history.

This not only provides much-needed financial assistance but also helps rebuild credit by making timely payments on the loan. Additionally, the flexible repayment terms which are between 3 to 60 months allow borrowers to find a repayment plan that works for their budget.

This makes this lending platform a great resource for those who need a loan but may not have the best credit history. their loan range of $500 to $10,000 also provides a wide range for those in need of varying loan amounts.

Overall, Bad Credit Loans offers a simple and efficient way for individuals to get the funds they need, regardless of their credit score.

Viva Payday Loans

Viva Payday Loans is a reputable payday loan provider that offers a transparent and straightforward approach to providing short-term financing.

They prioritize honesty and clarity, ensuring that customers fully understand the fees, rates, and terms associated with their loans right from the start. One of the major benefits of choosing Viva Payday Loans over FastLoanAdvance is their transparent fee structure.

With Viva Payday Loans, borrowers can have peace of mind knowing exactly what they are paying for, without any hidden fees or surprises. This level of transparency is crucial when taking out a loan, as unexpected fees can quickly add up and make it difficult to repay on time.

In addition to their transparent fees, Viva Payday Loans also offers a wide range of loan amounts to fit the unique needs of each borrower.

Whether someone needs a small amount for a short term needs or a larger sum for more significant expenses, Viva Payday Loans can provide loans ranging from $100 to $5,000.

With a streamlined application process, borrowers can often receive approvals within minutes and have funds give as early as the same day. This speed and reliability make Viva Payday Loans a top choice for Americans in need of quick cash.

Furthermore, Viva Payday Loans offers dedicated customer support to assist borrowers throughout the borrowing process. Their commitment to superior customer service further solidifies them as an excellent alternative to FastLoanAdvance.

24/7 Lending Group

24/7 Lending Group is a trusted and reliable lending network that has been helping consumers since 2001. With their extensive experience in the industry, they understand the financial needs of individuals with bad to fair credit and have tailored their services to cater to them.

Unlike traditional lenders who often reject loan applications based on credit scores, 24/7 Lending Group considers all credit types and welcomes everyone to apply. One of the standout features of 24/7 Lending Group is their simple and quick application process.

In just five minutes, you can complete your application and be on your way to receiving multiple loan(range from $500 to $35000) offers. This not only saves you time but also allows you to compare different options and choose the best one for your needs.

And the best part? There is no charge for using 24/7 Lending Group’s services. They understand that financial struggles can come unexpectedly and aim to provide a hassle-free lending experience without any hidden fees or charges.

Moreover, with a Trustpilot rating of 4.7 out of 5 and over 2,000 reviews, it is clear that 24/7 Lending Group has built a strong reputation for their excellent customer service and reliable loan offerings.

This level of trust and satisfaction from their customers speaks volumes about their commitment to helping individuals in need of financial assistance.

When it comes to interest rates, 24/7 Lending Group offers competitive rates starting at 5.99% and going up to 35.99%. This range allows borrowers with different credit profiles to find a suitable option that fits their budget.

Additionally, the loan terms offered by 24/7 Lending Group are also flexible, ranging from 60 days to 72 months.

Factors to Consider Before Applying for a Loan with Fast Loan Advance

Understanding the Total Cost of Borrowing

When considering applying for a Fast Loan Advance, it is crucial to understand the total cost of borrowing. Fast loans Advance often come with high interest rates, which mean that you will end up paying back more than what you borrowed.

It is essential to carefully review the terms and conditions of the loan to know exactly how much you will be required to repay.

Ability to Repay on Time

Fast loans Advance typically have short repayment terms, sometimes requiring repayment by your next payday. This can be challenging if you are already struggling financially.

Before applying for a loan from FastLoanAdvance, make sure that you can afford to repay it on time without putting yourself in further financial strain. Failure to repay on time can result in additional fees and a negative impact on your credit score.

Beware of Hidden Fees

Many lenders may charge additional fees such as origination fees, late payment charges, or rollover charges. These charges can add up and significantly increase the total cost of borrowing.

It is crucial to read and understand the loan terms carefully to avoid any unexpected charges. If you come across any hidden fees, it might be best to consider alternative options.

Loan Amount Requirements

Before applying with a FastLoanAdvance, it is essential to determine how much money you need. Some lenders may only offer small loans, while others may be able to accommodate larger loan amounts.

If you require a larger loan, such as a $3,000 installment loan without a credit check, make sure your chosen lender can meet your needs.

Avoid Getting Stuck in a Debt Cycle

One of the biggest concerns with short-term loans is the potential for a debt cycle. If you are unable to repay the loan on time, you may find yourself needing to take out another loan to cover the previous one.

This can create a cycle of debt that can be challenging to break free from. To avoid this, only borrow what you can afford to repay and resist the temptation to take out multiple loans at once.

Read More: Is Modo Loans Legit? An Essential Guide

Is Fast Loan Advance Legit? Conclusion

So, I can say based on my research that Fast Loan Advance is a valid and trusted platform for financial emergency those who need fast cash. They have strict security measures in place to protect customer information, along with clear disclaimers and promises of transparency.

By collaborating with reputed lenders and providing reliable and efficient services, Fast Loan Advance has established itself as a reliable source for fast loans. So if you need some quick cash for an urgent need, you can feel confident using the services of Quick Loan Advance.

Finally, keep in mind that there are risks involved in every case, so you should do your research before making any decision. You can also check customer reviews and get feedback from someone you know who has availed loan services from this platform.

Source:

https://fastloanadvance.com/

https://www.trustpilot.com/review/fastloanadvance.com

https://www.badcredit.org/how-to/fast-loan-advance-review/

https://financer.com/loans/articles/fast-loan-advance-review-and-5-best-alternatives/